CSOFT Health Sciences sat down with Dr. Vladimir Misik, board member of leading European CRO, SanaClis, as well as Partner and Founder of LongTaal, and Partner and Co-founder of VIARES Academy, in our newest podcast episode of Coffee & Conversations to evaluate the geographical clinical trial market and industry investment. Clinical trial market competitiveness has come a long way since 1997, the year of the ICH GCP adoption (the international guidelines for Good Clinical Practice for human clinical trials). With the rise of emerging markets and the changing distribution of clinical trial allocation, how do biopharmaceutical companies make the best decisions when choosing where to conduct clinical trials? How can we predict future trends of biopharma investment? To quantify the nature of industry investment, Dr. Misik uses his Clinical Trial Reputation Index as a guidance for evaluating global market trends.

As it stands, the biopharmaceutical industry spends more than $USD100bn annually on development of innovative medicines. Out of that investment, more than $USD40bn is spent on recruitment of patients [1]. Industry R&D clinical trials are critical marketing tools in the biopharma industry, and early and effective exposure of future prescribers to products in new markets during clinical trials, is one of the key factors which determines the post-launch commercial success of a product.

In the beginning of this podcast episode, Shunee and Dr. Misik give an overview of recent historical trends in the global clinical trial market. Referencing graphs used in his keynote speech at the Clinical Trial Europe 2019 in Barcelona, Spain, Dr. Misik explained how 1997, with the adoption of ICH-GCP, was really the year where the global competition for clinical trials began to intensify. In the years before 1997, the vast majority of industry clinical trial sites were located in North America and Western Europe. Following 1997, however, North America and Western Europe gradually lost their dominant share in the field of clinical trials, as many new markets opened up.

By 2010, developed markets had lost about 30% of global share to research-hungry emerging markets. Aware of the socioeconomic benefits of industry clinical trials, many countries in North America and Western Europe adopted measures to stop this outflow. These measures proved successful as developed markets only lost 2.6 % of global share since 2010 and continue to maintain more than 70% of the global share today. It is worth pointing out that almost the entire loss of market share of the developed markets between 2010 and 2020 was caused by the market share gain (+2.3%) of a single market – China, which has been the fastest growing clinical trials market globally.

Dr. Misik named the market power of the larger markets, operational and financial measures adopted by many developed countries, combined with the increasingly smaller sized clinical trials, as main contributing factors for why the outflow from developed markets came to a halt. Dr. Misik spoke of how his Clinical Trial Reputation Index, a term and calculation algorithm he coined, can be used to predict the future allocation of biopharma-sponsored industry clinical trials (BPCTs).

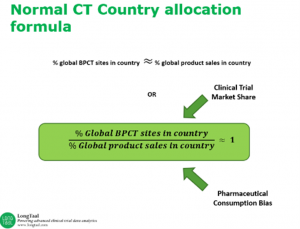

In their conversation, Shunee and Dr. Misik discuss how Clinical Trial Reputation Index can be used as a guidance to evaluate the relative attractiveness and competency of a country’s clinical trial market by comparing a county’s clinical trial market share relative to their share of consumption of pharmaceuticals. The Index assumes that sponsors of clinical trials do not act irrationally and that the allocation of clinical trials reflects their best interest in maximizing return on investment (ROI) in new product development.

Central and Eastern Europe (CEE) in particular stand out as regions that have enjoyed the highest allocation of clinical trials globally during the past two decades, in relative terms. Dr. Misik’s team has predicted that without systemic, far-reaching government-backed investments in clinical trial infrastructure, CEE’s position and growth is not sustainable and will not, “defy gravity”. Their predictions are proving accurate, as CEE has started losing market share during the past five years. An anomaly on the opposite side of the spectrum is the Middle East and North Africa (MENA) region, excluding Israel, which despite being a very buoyant pharmaceutical market, suffers from a smaller share of industry trials and is the most underrepresented region globally, in relative terms.

As explained in the episode, using this Reputation Index, Dr. Misik has also been able to make predictions on future market share trends: “Based on the imbalance between allocation of clinical trials and consumption of pharmaceuticals in 2006 we predicted that Japan’s clinical trial market would grow, which is in indeed what has happened – Japan’s CT market share grew more than 70% between 2007 and 2017, in relative terms. China has also been substantially underrepresented in global industry clinical trials, in relative terms, and has indeed been the fastest growing clinical trial market globally. Driven by the still existing gap between consumption of pharmaceuticals and participation in development of new products, China is likely to remain on a steady growth course in the coming years.”

Highlighting some clinical trial trends around the world, Dr. Misik stated that, “technology will re-define clinical trials of the next decade”, and that the markets that will emerge stronger in the near future will be those that enhance their technology-based remote, decentralized clinical trial competencies, and adoption of wearables. Dr Misik stated that CROs and sites that will be successful will be those that are “excellent users” and “early adopters” of technology. Notwithstanding the technology aspects of clinical trials, one old problem that is likely to remain and will continue to limit growth opportunities and drive up the cost of development: i.e. global chronic shortage of clinical trial resources in general and clinical research associates and clinical project managers specifically.

To listen and subscribe to CSOFT’s Coffee & Conversations podcast click here. To learn more about LongTaal’s clinical trial informatics visit their website here.

[1] Misik V, Brady RV, Bolecek M, Klech H, Recent trends in globalization of industry R&D clinical trials: are emerging markets losing their allure?, Applied Clinical Research Clinical Trials and Regulatory Affairs, June 2017. Vol 4,. pp. 175-182